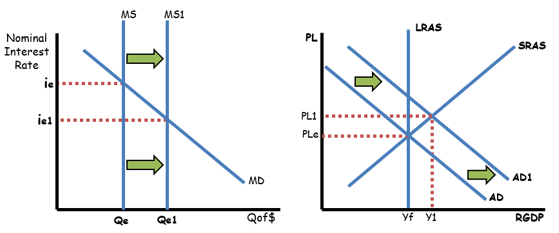

This causes an increase in the real GDP, which shifts aggregate demand to the right(AD 2). ExpectationsĮxpectations of higher inflation, higher future income, or greater profits will typically drive consumer spending and investments up. Let’s dive a little deeper to what shifts aggregate demand. Below is a graphic illustration of shifts in the Aggregate Demand curve. C+I+G+Xn) primarily constitute what shifts aggregate demand. What Shifts Aggregate Demand?Ĭhanges in the principal components of aggregate demand (i.e. However, other factors can shift aggregate demand and aggregate supply curves-let’s have a look. Fig 2.1 Short Run Aggregate Supply curve (SRAS) Fig 2.2 Long Run Aggregate SupplyĬhanges in price levels, holding other things constant ( ceteris paribus), causes movements along both aggregate demand and aggregate supply curves. This depicts that supply is inelastic to price level changes since all factors of production are considered flexible. Thus, the long run aggregate supply curve is almost vertical. In the long run, the prices of resources necessary for production are considered variable, and real GDP is equal to the potential GDP. However, long run aggregate supply is not affected by price, but by the number of laborers, capital stock available, and level of technology.

#Money market graph full#

The term “short run” indicates a time frame in which prices of some resources remain “sticky” and the real GDP is not necessarily equal to the potential GDP or full employment GDP. Producers do this by increasing the utilization of existing resources to meet a higher level of aggregate demand.

In the short run, rising prices ( ceteris paribus) or higher demand causes an increase in aggregate supply. To correctly understand the aggregate supply curve, time is an essential factor. An aggregate supply curve indicates the connection between different price levels and the amount of real GDP supplied and it is represented by an upward sloping curve. Aggregate supply refers to the total amount of goods and services that producers are willing to supply within an economy at a given overall price level. Now that you have a firm picture of aggregate demand, let’s look at the supply side. This drives the market to demand more foreign currency, causing a weakening of the dollar and a reduction in exports, which drives the real GDP down further. Exchange Rates EffectĪn increase in price also makes people prefer to purchase foreign products since they are cheaper compared to local goods. The spiral effect of increased interest rates is a reduction in investments (entrepreneurs are less willing to borrow to expand their businesses) and a dip in consumer spending (fewer people take mortgages or car loans and spend less using their credit cards). This reduces the amount of money available to banks to lend, and the lenders, in turn, raise interest rates to make an appreciable return. Higher prices not only put a strain on your wallet (consumer wealth), but also cause you to save less. At higher price levels or higher interest rates, the purchasing power (or real wealth) of consumers reduces, since they have to spend more to acquire each unit of a commodity. The slope is downward because of the following effects: Wealth EffectĬonsumer wealth responds inversely to changes in price. This means that increases in price levels, holding other factors constant ( ceteris paribus), results in a reduction in the aggregate demand. When you take a closer look, aggregate demand is the same as real GDP, especially the long run aggregate demand and is typically depicted by a downward sloping curve.

It is expressed as the sum of all consumption (C), investments (I), government expenditure (G), and net exports (Xn). It is expressed as the total amount of money paid in exchange for those goods and services and represents different output levels at various prices.

What is Aggregate Demand and Supply?Īggregate demand is an economic measurement of the total sum of all final goods and services produced in an economy. We will also see how you can be tested on these concepts on the AP® exam. We will look into the concepts, what shifts aggregate demand and aggregate supply, and why these concepts are important. If you are having a hard time understanding these two concepts for your AP® Macroeconomics exam, then this article is for you. On the other hand, aggregate supply is the total value of all goods and services producers are willing to supply in an economy over a specified time at different price levels. When we consider the total expenditure by each person in the entire country (including what is spent by the government and businesses), it is called aggregate demand. Believe it or not, it contributes to national macroeconomics. Have you ever calculated how much you spend in a year? The amount of money you spend within a particular period constitutes your total demand.

0 kommentar(er)

0 kommentar(er)